Budget With Chippy

Chippy is a cash-based budget planning app for creating an intentional budget without tracking income and expenses.

Chippy is a cash-based budget planning app for creating an intentional budget without tracking income and expenses.

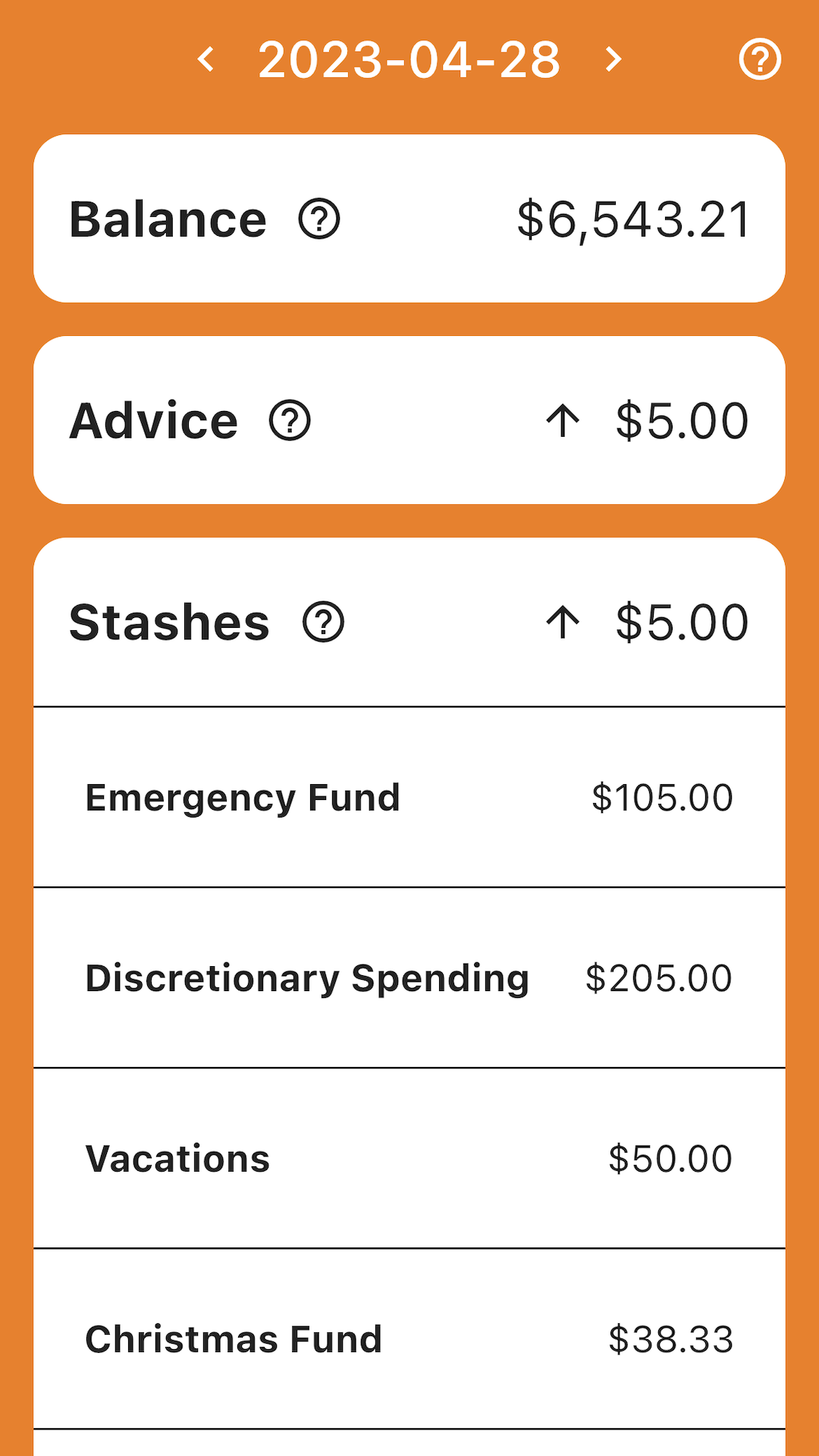

Chippy organizes discretionary income into “stashes”. Create a stash for each saving, discretionary spending, investing, or extra debt payment item in your budget. Set aside money in each stash every week to keep your goals on track and your spending within budget.

How it works

1. Create stashes for broad discretionary budget categories and designate a separate bank account or bucket for each.

2. Set up automatic weekly transfers from your main checking account into each individual stash using your bank's app or site.

3. Make purchases using your main checking account for essential and committed expenses. Make all other purchases with its designated stash.

4. Update your main checking account balance in Chippy each week. Chippy will analyze weekly balance trends and offer advice if weekly stash transfers are too high, too low, or just right. Adjust your budget and transfers as needed.

How is Chippy different than other budgeting apps?

-No income or expense tracking required. Instead, split discretionary income into individual stashes for goals or spending.

-Cash-based approach. No need to consult a written budget when making purchases, only available cash or bank account balances.

-Prioritizes essential spending. Chippy analyzes trends to the available balance in your main checking account to ensure sufficient cash is available to cover committed expenses

-Only requires a few minutes each week. Start each week with last week’s budget and only make adjustments as necessary.

-Frequent feedback loop. Check in each week to make sure your budget is on track and adjust as needed.