Daily Finance

We’ve solved this problem by a solution of our own in the form of Daily Finance app which helps small-scale finance firms to manage their finances efficiently.

Nowadays, a small section of individuals are making money by providing financing help to other individuals on the simple interest basis. Even in these digital days they still need to use the books without a proper accounting software.

We’ve solved this problem by a solution of our own in the form of Daily Finance app which helps small-scale finance firms to manage their finances efficiently. Daily Finance app is a well crafted and beautifully designed mobile application which provides a simple and efficient accounting software for small-scale finance firms.

The app can be used as a platform for money lenders and borrowers to get rid of their account books and go digital. Daily Finance helps customers to manage their finance business like a pro.

App also includes a solution for allowing the agents to collect money from the borrowers towards the loan. Any borrower in search of financial help can install the app and can directly contact the money lenders to see if they can receive any financial help. The application provides a platform for both the parties (money lenders and borrowers) to be connected and seek financial help.

App Features:

Online and Offline mode:

The app works seamlessly whether the device is connected to the internet or not. App user doesn’t have to worry about the device being connected to the internet.

Security:

Security of our customers is more important to us and that’s why data is retained securely by our app using any device and can only be given access to the data after authentication. App uses the best in industry security measures to safeguard users data.

Personal Settings:

The user can set their own default interest rate and the number of installments in settings screen and can even personalize other settings related to the app usage.

Full accounting history:

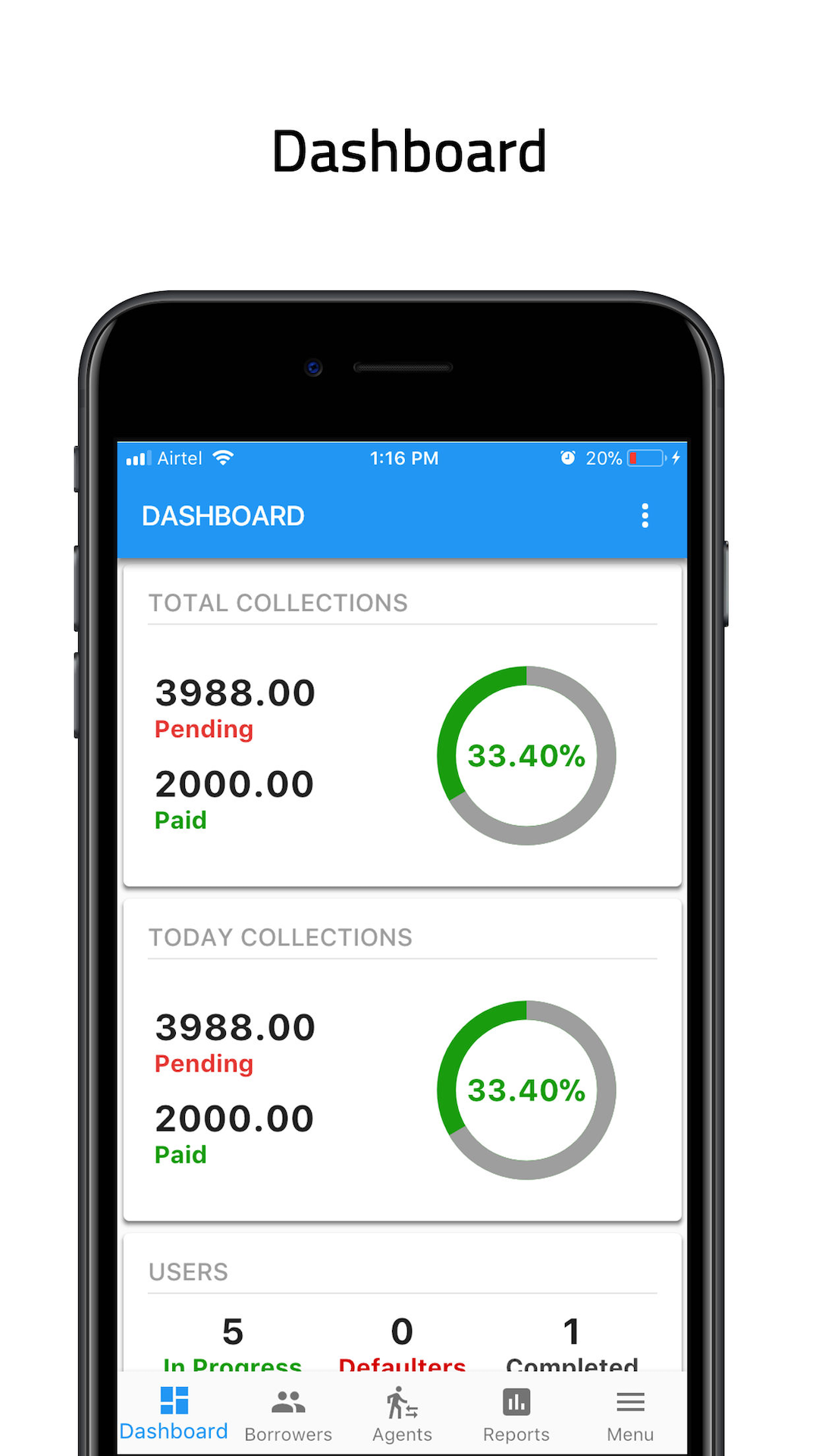

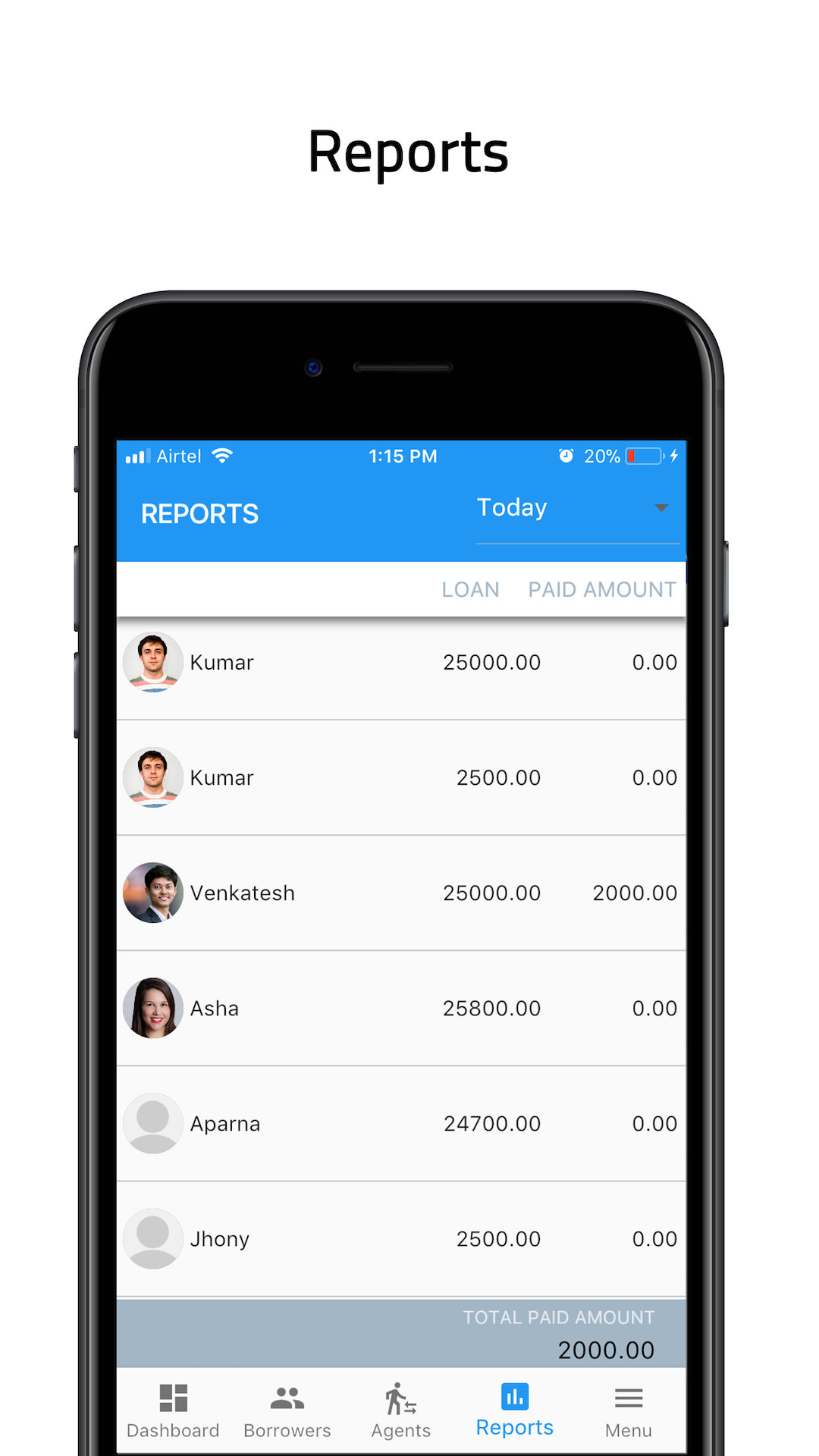

App provides the complete history of payments towards a loan made by the borrowers and calculates the remaining balances depending on the payments history. Users can check the Outstanding payment, Collection and Balance Amount for each loan/customer.

Reports:

App provides a detailed report daily, weekly, monthly, or yearly for credits, debits, profit, and loss (consolidated).

Supporting Languages:

App supports International languages English and Spanish, and Regional Languages Hindi, Telugu, Tamil.

Users who sign up with the app will be given a choice to select the mode they will be using the app for, Money Lender or Borrower.

Money Lender Mode:

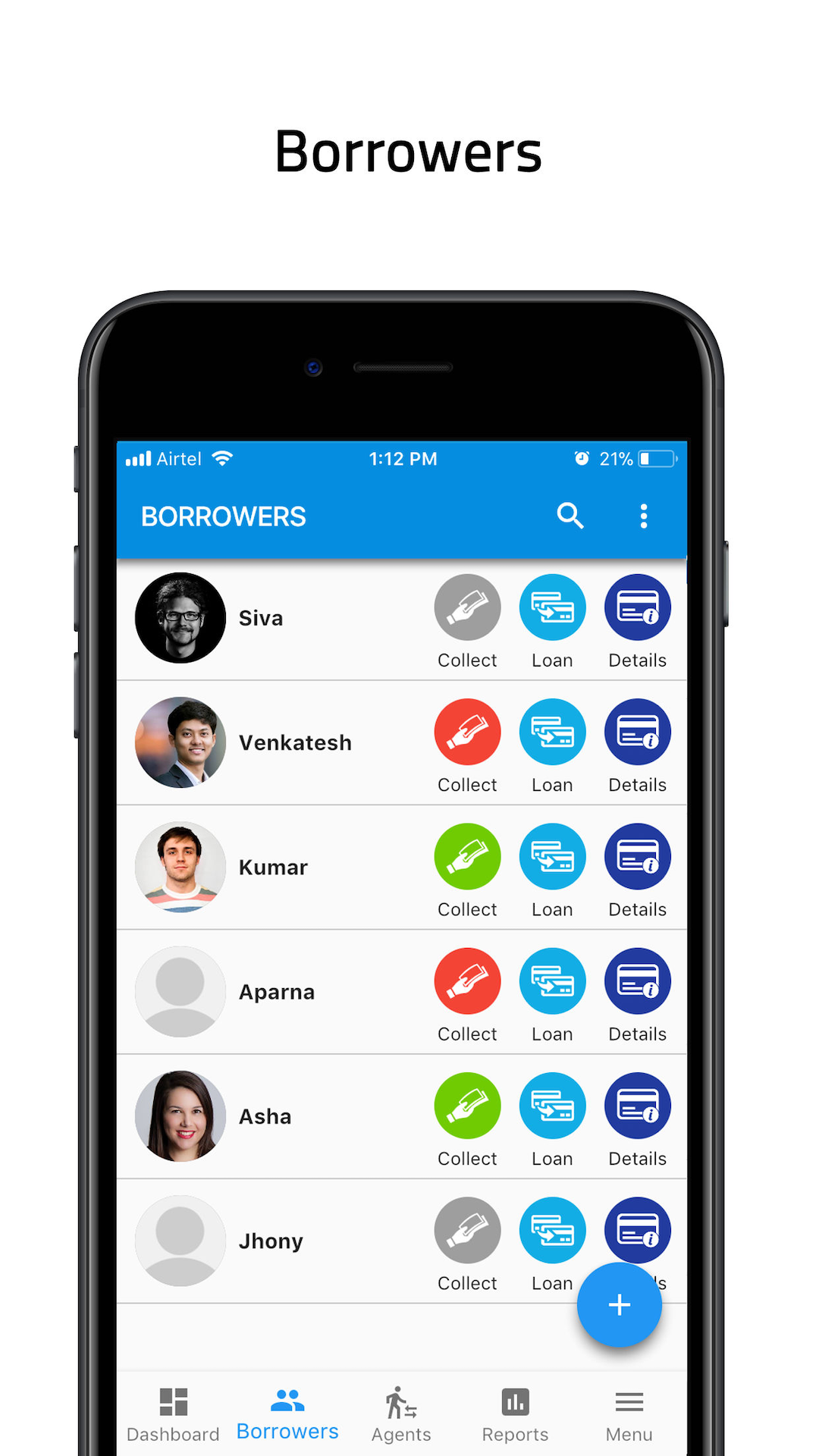

When a user signs up for money lender mode they can use the borrowers' screen to add new borrowers and then make entries for the loans that are lent to each borrower. Users in money lender mode can also add Agents, who can make a collection on behalf of money lenders.

Borrower Mode:

When a user signs up as a borrower, they can see the lenders near their location and can check their loans if anything is due with money lenders, who are using the Daily Finance app. The user who signs up as a borrower can keep track of his loans with the money lender who is also using this app and can even check the full history of payments made, amount due, end date of the loan, etc.

Agents Mode:

Agents can only be added on to the system by Money Lenders. The user who was added by money lender can simply log in with the same mobile number which was used by money lender to add them as an agent. Agents can only make a collection towards a loan against borrowers who are assigned to the agent by money lender.